Commission-free buying and selling has turn out to be extra frequent amongst on-line brokers, however it’s important to verify for different hidden fees that will apply to your account or specific transactions. ETRADE is one other popular brokerage agency catering to beginners and experienced traders. The agency presents commission-free buying and selling on stocks, ETFs, and options. ETRADE offers https://www.xcritical.com/ a user-friendly platform for new investors and entry to advanced trading instruments for more experienced traders.

Brokerage Accounts 101: Sorts & Advantages Defined

The SEC oversees the securities industry, protecting buyers by enforcing fair and environment friendly markets. It works to forestall fraud, insider buying and selling, and different unlawful practices. FINRA, then again, regulates brokerage companies and their workers to ensure they act in clients’ best interests. Each organisations additionally promote transparency in financial markets by requiring brokers to disclose important info to investors. Earlier Than choosing a brokerage agency, assessing your funding brokerage as a service targets is necessary.

A brokerage account is usually used to build future monetary security or invest for long-term objectives. Robo-advisors are a viable different for less-experienced buyers and those on the lookout for a hands-off strategy, particularly since they’re also very cost-effective. Some robo-advisors cost fees as little as 0% annually, although the business average is at present between zero.20% and zero.30% annually. A 12B-1 charge is a recurring charge that a broker receives for selling a mutual fund.

Education Planning

The suitability normal requires the broker to advocate actions which may be suitable to your personal and financial circumstances. The larger fiduciary commonplace requires the broker to act in your finest interests. The identical names pop up for cellular brokerage apps, together with newer opponents corresponding to Robinhood and Acorns.

EToro is the best online broker for each new and lively merchants looking for a singular social trading platform with a user-friendly interface and low fees. We consider everyone should be capable of make monetary decisions with confidence. Brokerage fees, also called broker charges, could be charged as a proportion of the transaction, a flat fee, or a combination of the 2. J.B. Maverick is an active trader, commodity futures dealer, and inventory market analyst 17+ years of expertise, along with 10+ years of expertise as a finance author and book editor.

Traders who favor a do-it-yourself investment approach would possibly think about a reduction brokerage agency. These firms charge significantly decrease charges than their full-service counterparts but additionally provide fewer companies. Discount brokerage corporations, such as Schwab (SCHW) and Fidelity (FIS), are best suited to cost-conscious traders who prefer to make their own trading and investing choices. Investors looking for the expertise of a financial advisor can think about full-service brokerage corporations corresponding to Merrill, Morgan Stanley, UBS, and Wells Fargo Advisors, among others. Monetary advisors are paid to assist their clients develop funding plans, execute trades, monitor investments and market trends, and extra.

Different Products & Companies:

Full-service brokerage accounts and wealth-management corporations often calculate their costs as a share of your whole portfolio, and may have account minimums as high as $250,000. They may collect commerce commissions and annual management fees. Many brokerage corporations can supply resources to help investors explore and examine totally different investments.

Margin Accounts: Dangers And Opportunities

- In this text, I’ve answered important questions like what are stockbrokers and what do brokers do.

- If you probably can’t meet a margin name, your dealer might close some or your whole positions to fulfill the margin requirement.

- These sources can include online courses, webinars, articles, and movies on numerous topics, such as market evaluation, funding strategies, and retirement planning.

- This safety is usually restricted to a set amount, masking up to $500,000 in securities, together with $250,000 in cash.

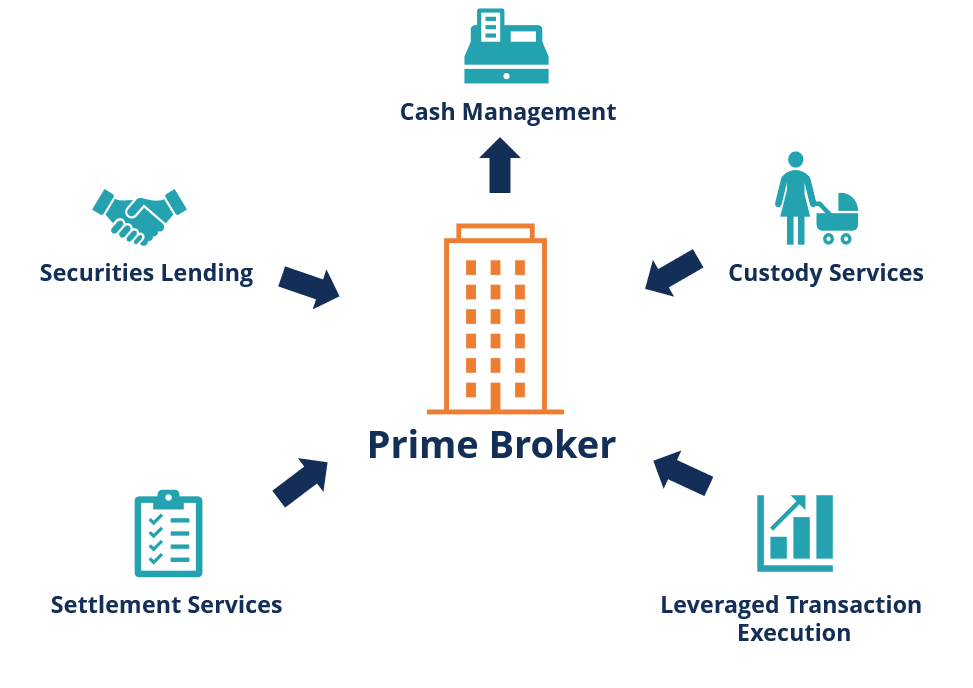

- A brokerage firm is a specialized firm that performs a vital role in helping individuals purchase and promote various monetary devices like shares, bonds and options.

However what actually places it ahead of the competition is its many distinctive options, similar to CopyTrading. Trades don’t just occur spontaneously — you want a broker to execute them. This just isn’t monetary advice nor is this a recommendation of M1 or any investments or methods Peer-to-peer mentioned in this video. Our partners cannot pay us to guarantee favorable reviews of their products or services. Brokerage corporations maintain copies of commerce affirmation for 3 years.